Empowering Small Businesses with 01 POS Loan

At 01 POS, we connect small businesses with peer-to-business loan opportunities designed to support consistent growth. These tailored loans come from trusted providers, giving you the financial boost you need to keep your business moving forward on your terms.

How It Works

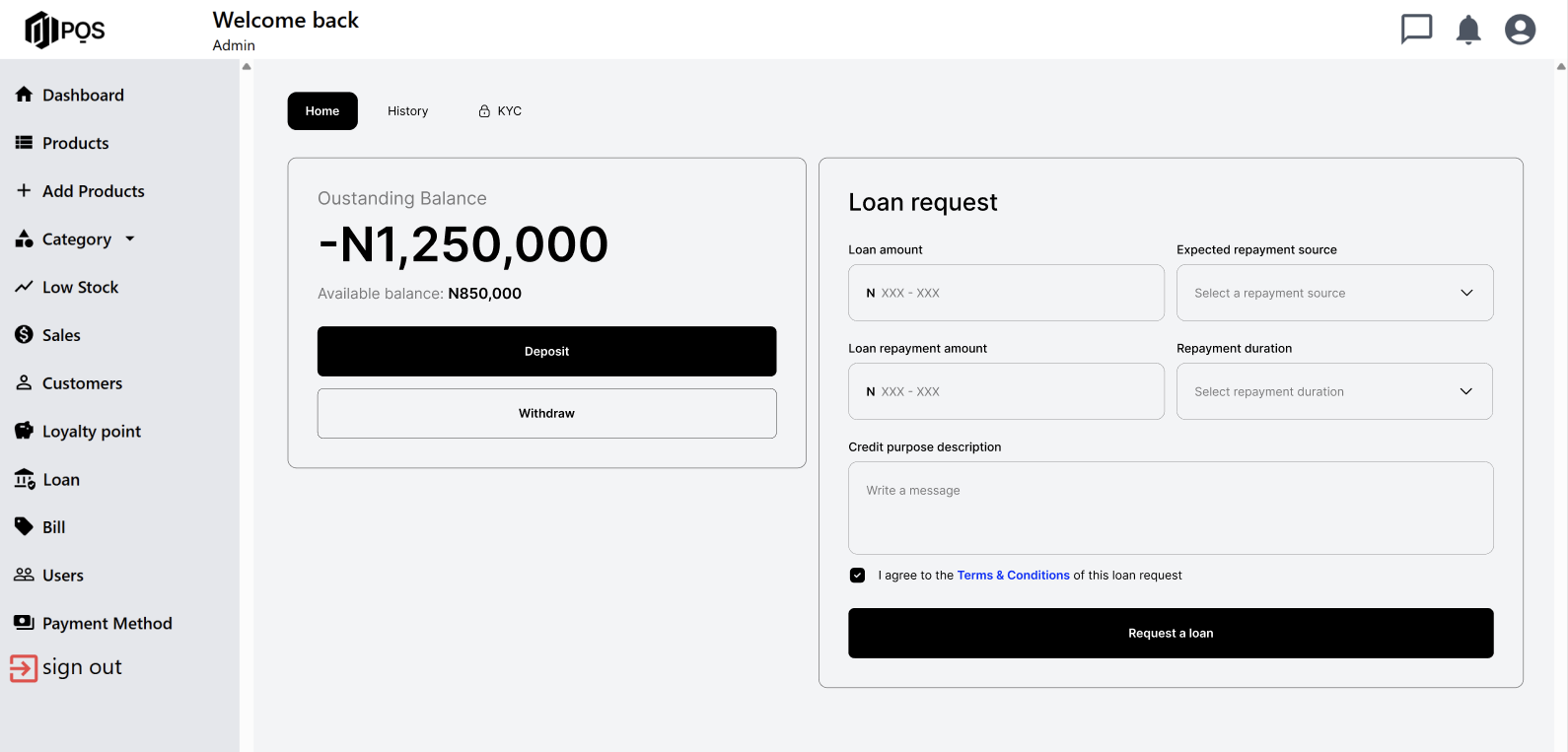

Purchase the Compact or Compact Plus package to activate your admin account and start managing your business with ease.

Submit the required information to verify your business and activate loan features.

Record sales and inventory consistently for at least 7 months.

When eligible, submit your loan request through the admin account for processing.

After a lender funds your request, the loan will be credited directly to your verified bank account.

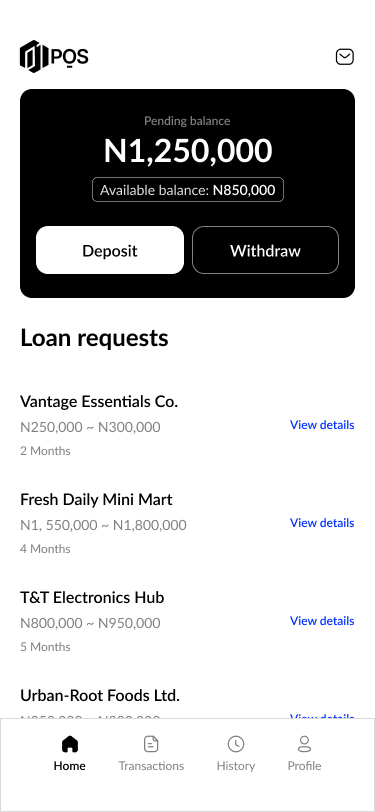

Install the 01POS Lender App from the App Store.

Verify your identity and activate your lending account.

Add money to your lending wallet within the app.

Browse available loan requests and fund the ones that meet your criteria.

Interest from your loans will be credited to your account as businesses repay.

Am I Eligible to Apply?

-

- Business Type:

Sole trader or limited company -

- Tax Resident:

Lagos tax resident

Why Small Businesses Deserve More Loan

We believe small businesses deserve the same level of financial support as the big players. That’s why our loan options are built to empower not restrict you. With 01 POS, you get access to funding that supports your ambitions.

Click here to join our whatsapp group

Click here to join our whatsapp group